For more than 40 years, the Alpaugh Family Economics Center has trained teachers, developed classroom materials, and revolutionized economic and financial education for students from kindergarten through high school. We focus on teaching students the decision-making skills that lead to their own financial resiliency, and ultimately, robust communities.

- Have higher rates of savings

- Have higher credit scores

- Are more likely to have an emergency fund

- Have fewer loan defaults

- Are more responsible consumers

40K+

~900

- Providing innovative resources such as the award-winning $martPath platform to teachers and parents across the country

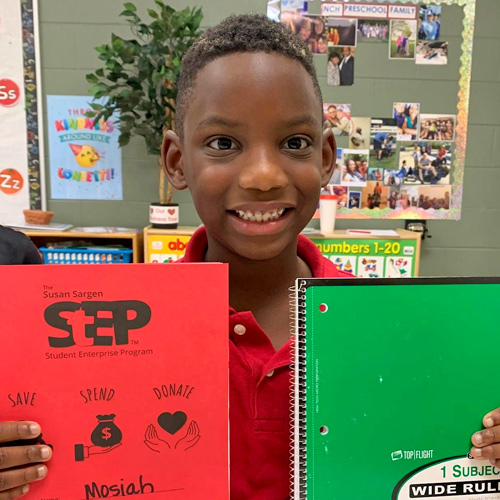

- Focusing on experiential, direct-to-student programs such as StEP and Market Madness to teach children about spending, saving, entrepreneurship, and giving back

- Developing a ground-breaking series of videos featuring puppets and music to teach the youngest learners about economics and personal finance

- Continuing to add new, downloadable, free curriculum resources for teachers and families

The Center offers dozens of Professional Development workshops every year. During the pandemic, our workshops are offered virtually. Teachers earn CEUs for attendance, and may buy college credits as well.

$martPath is our award-winning online financial program designed for students in Grades 1-8. $martPath provides standards-aligned lessons in a fun, engaging way. And we have puppet videos, too!

Thanks to a generous grant from the Charles H. Dater Foundation, we studied the current state of financial education in schools across Greater Cincinnati, then recruited master teachers to help us draw some conclusions.