A Path Forwardon financial literacy

The positive outcomes associated with financial and economic education are well-documented. But there aren’t uniform, consistent requirements for this instruction in schools across Ohio and Kentucky. Thanks to a generous grant from the Charles H. Dater Foundation, Center researchers studied the current status of high school financial education instruction in the seven-county Cincinnati region. Then a group of Center-chosen master teachers spent months identifying the best practices for financial and economic education in high schools.

Research demonstrates that economic and financial education makes a real difference in students’ lives, and their ability to navigate complex decisions.

Students who have received financial education:

- Have higher credit scores and lower default rates

- Have lower student loan balances and lower incidences of late payments and defaults

- Have higher savings rates

- Have higher degrees of confidence in managing money

- Have higher probabilities of building emergency funds and not living paycheck to paycheck

What Researchers Learned

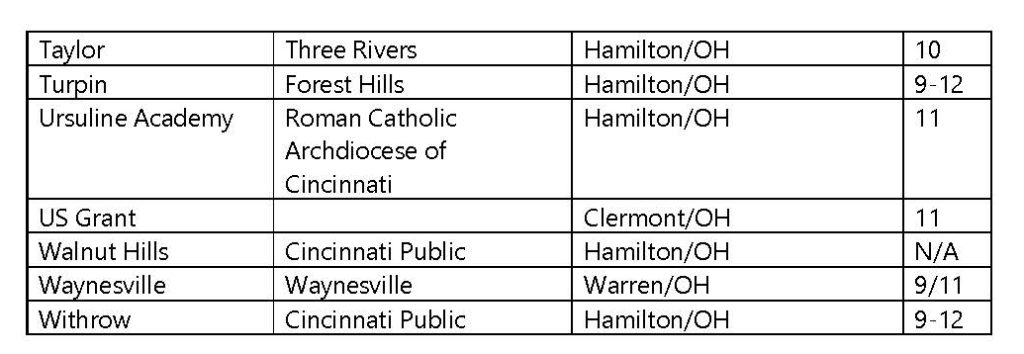

In order to get a clear picture of how financial education is delivered in the high school setting in the 7-county Greater Cincinnati region, Center researchers studied those offerings at 88 high schools.

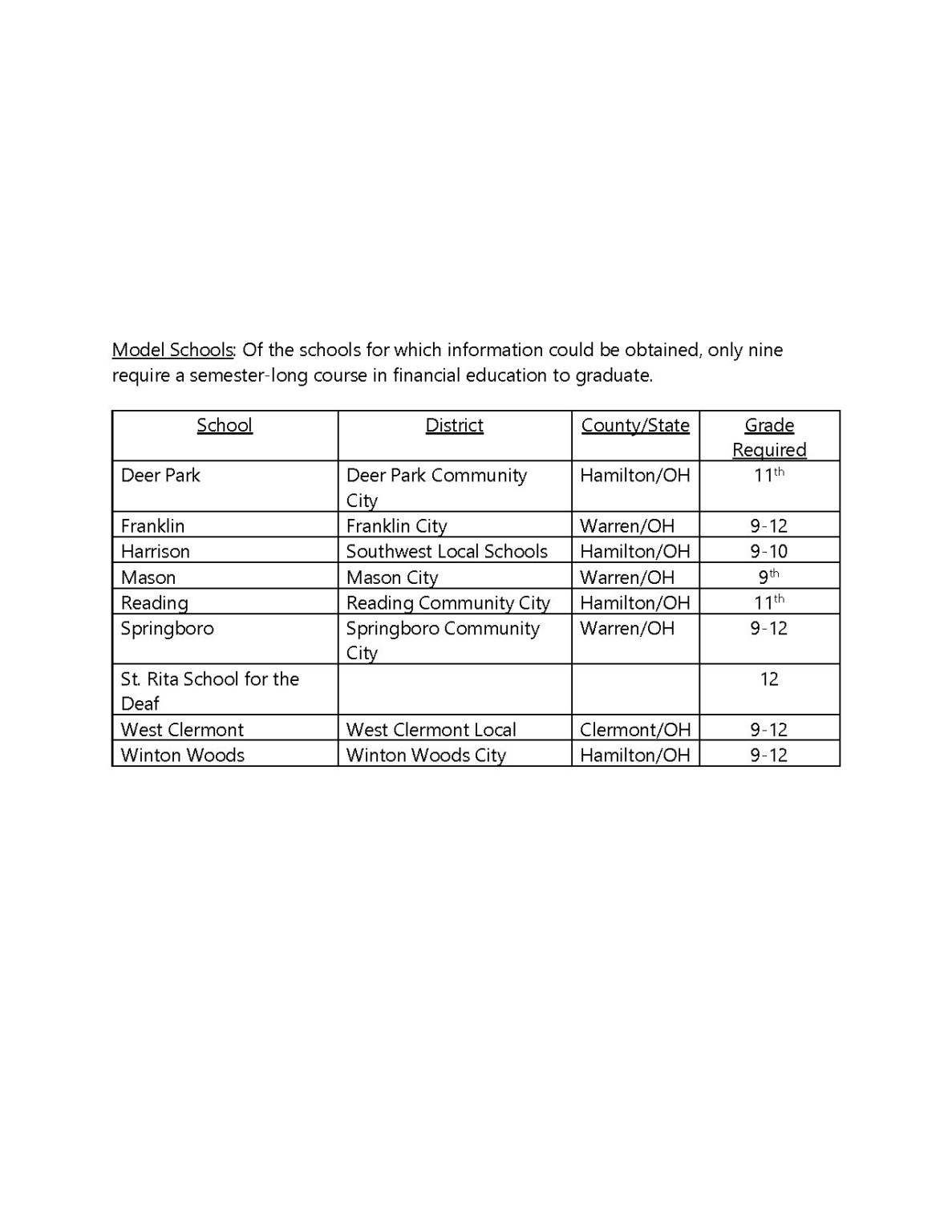

- Of the 84 schools studied, only nine include a stand-alone, semester-long course in financial education to graduate. We’ve dubbed those “model schools”.

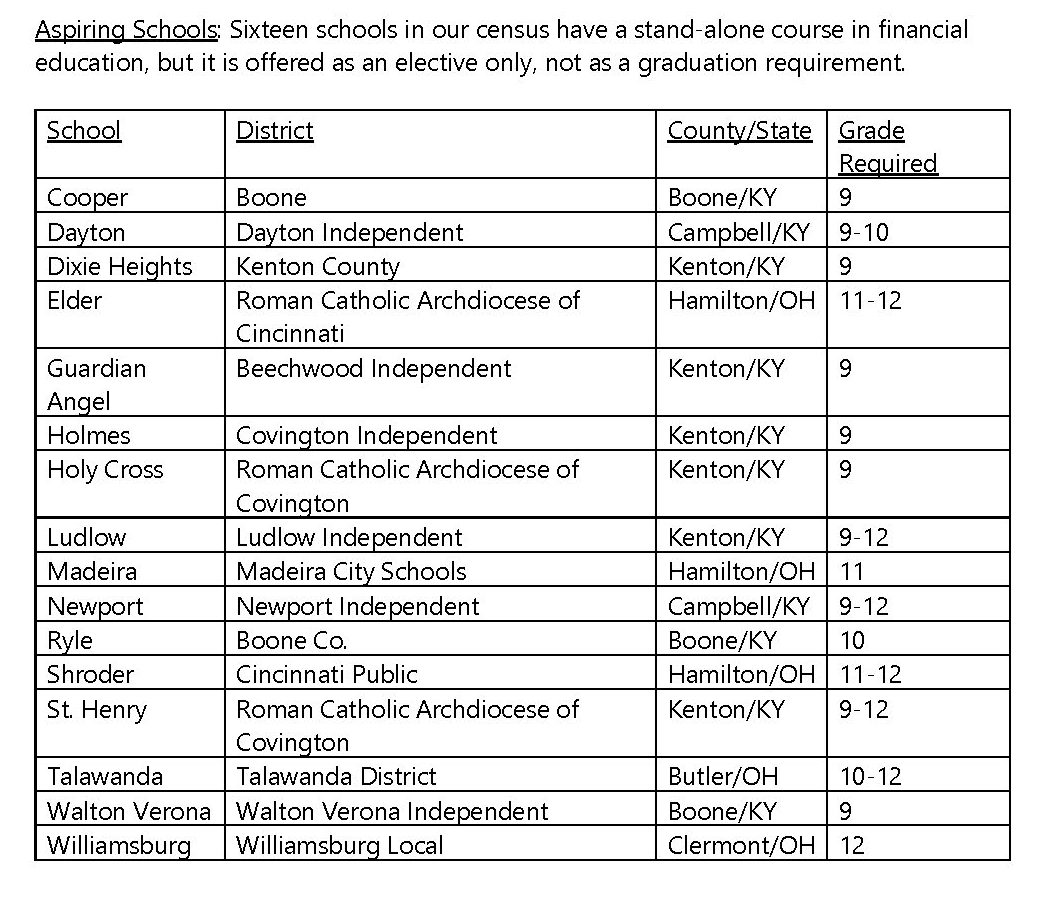

- Sixteen others offer such a course, but they don’t require students take it. We’ve called those “Aspiring Schools”.

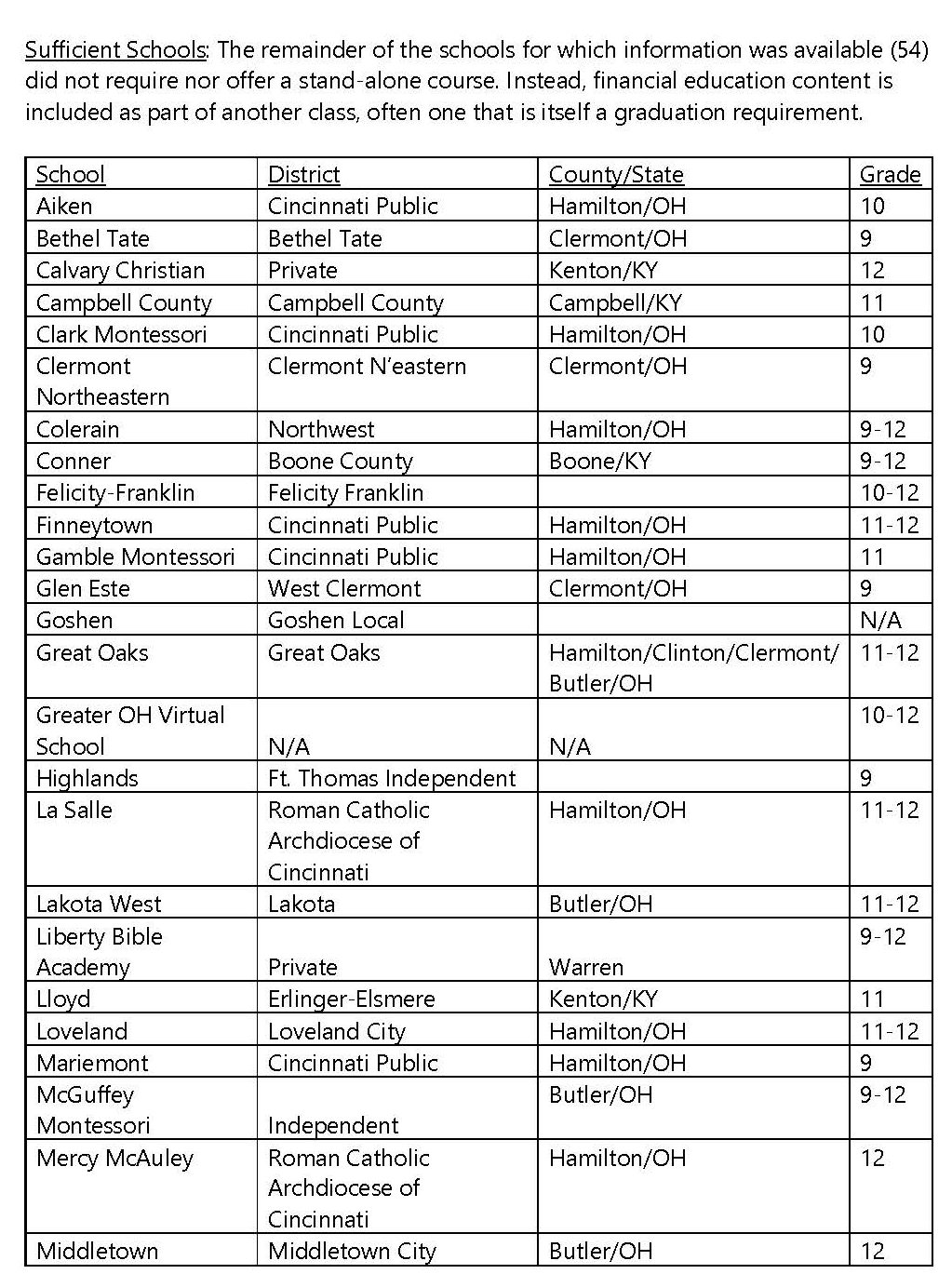

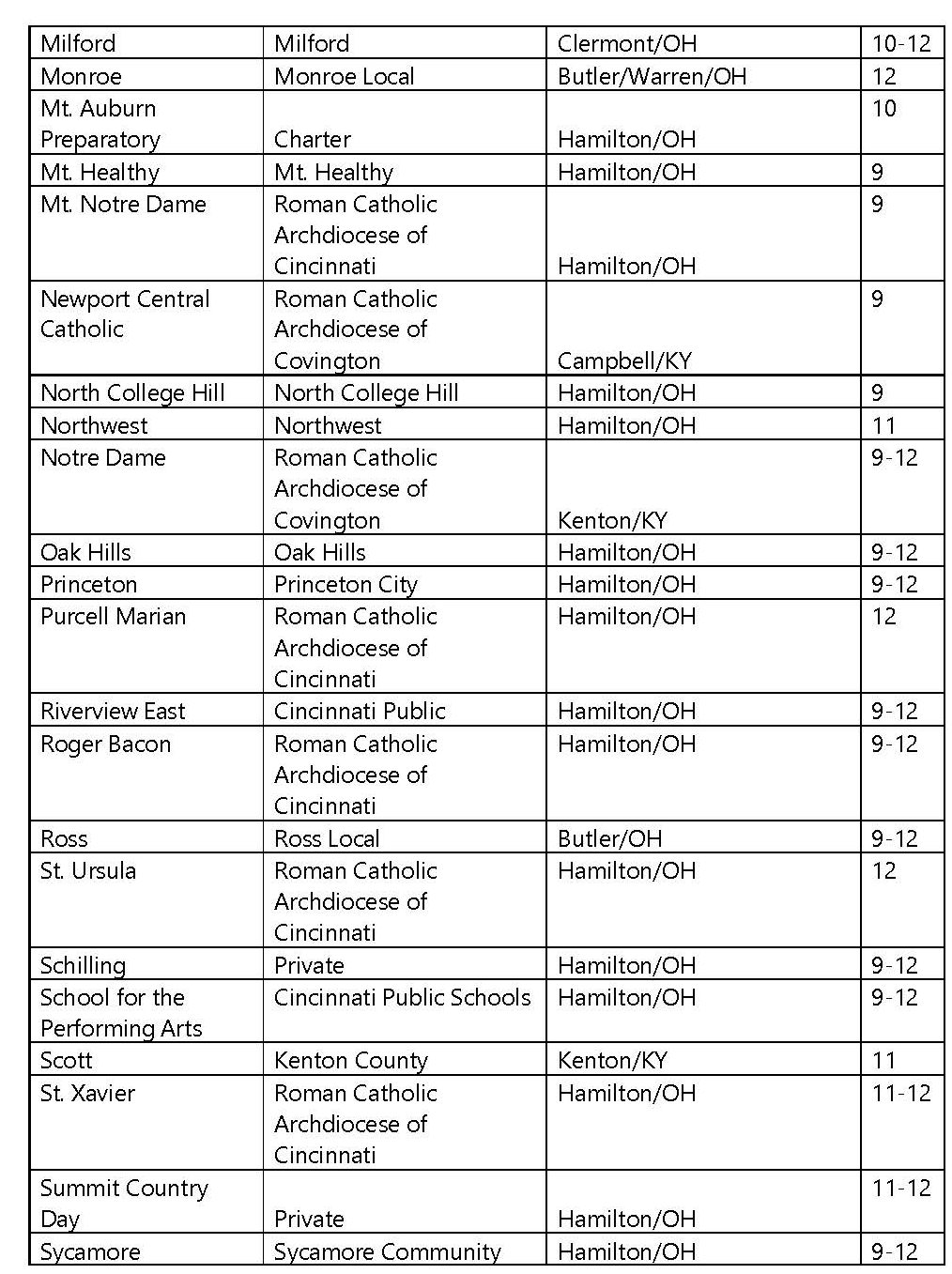

- Fifty-four high schools in the Cincinnati region do not offer a course, either as an elective or requirement, but instead include financial education as part of another required course. We’ve called those “Sufficient Schools”.

- Ten high schools didn’t respond to our requests.

Click To Read The Full Report